Self employed entrepreneurs.

DEFINITION:

Self employed individuals

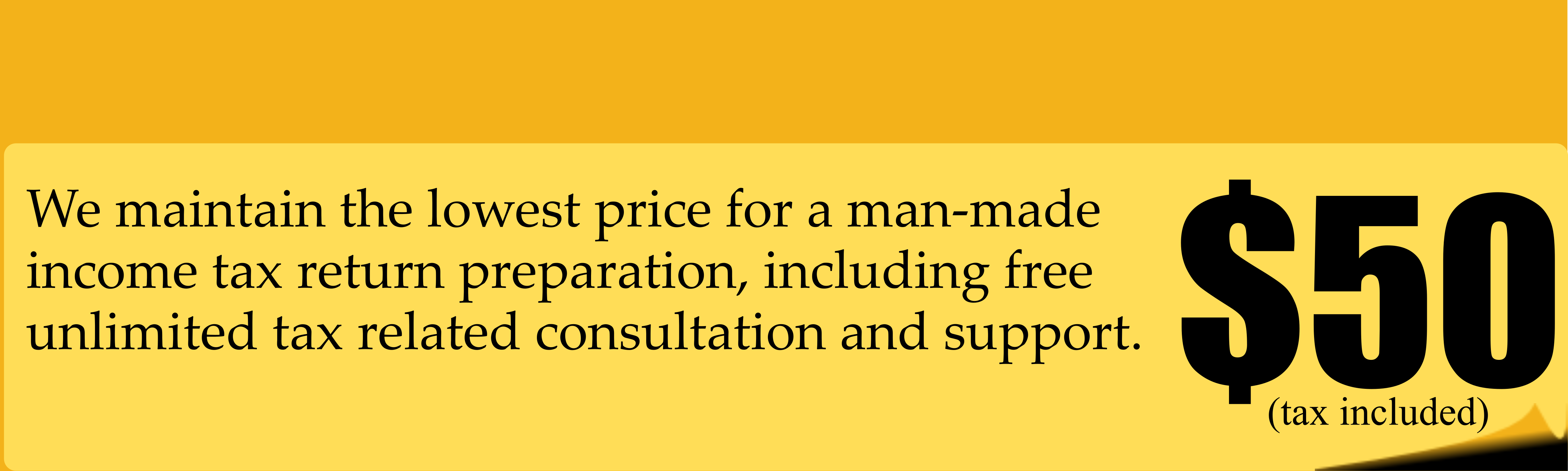

SERVICE FEE:

- Our rates for a self-employed entrepreneurs starts from $99.00 per income tax return, please contact us for your individual quote.

List of most common documents for self employed individuals:

| Title | Mandatory | Value/ check mark |

| Latest notice of Assessment. | - | |

| SIN number | +* | |

| Telephone number | + | |

| Mailing address | + | |

| Your date of birth | +* | |

| Marital status | + | |

| Gender | + | |

| Are you Canadian citizen | + | |

| Do you have a property outside of Canada value over $100,000 CAD? | + | |

| Did you pay rent? If yes, how much and your Landlord's name. | - | |

| T4, Statement of Remuneration paid | - | |

| T4A, Statement of Pension, Retirement, Annuity and Other Income | - | |

| T4E, Statement of Employment Insurance and Other Benefits | - | |

| T4A (OAS), Statement of Old Age Security | - | |

| T4A (P), Statement of Canada Pension Plan Benefits | - | |

| T4RSP, Statement of RRSP Income | - | |

| T5007, Statement of Benefits | - | |

| RC62, Universal Child Care Benefit Statement | - | |

| RC210, Working Income Tax Benefit Advance Payments Statement | - | |

| T5, Statement of Investment Income | - | |

| T3, Statement of Trust Income | - | |

| RRSP Contribution Slips | - | |

| Medical (dental) receipts | - | |

| Charitable donation receipts | - | |

| T2202A, Tuition, Education, and Textbook Amounts Certificate | - | |

| Interest paid on student loan(s) | - | |

| Professional /union dues | - | |

| Spouse support: payment, income | - | |

| Dependent information (children, parents, spouse) | - | |

| Child Care Expenses: receipts. | - | |

| Children Arts/Sport programs: receipts | - | |

| Property Tax paid | - | |

| Rent paid (Landlord name) | - | |

| Moving Expenses | - | |

| Transit Pass receipts | - | |

| Capital Gain/Losses records | - | |

| Sole proprietor (self-employed) expenses (receipts / summary of receipts) | - |

- Not mandatory

+ Mandatory

+* - applicable to those who do their income tax return first time with us.